A Step-by-Step Guide with Tips for Former Qube Users

Starting fresh with Crew is super simple, even if you’ve never used a budgeting app before. If you’re coming from Qube, I’ll include tips so you can quickly spot the main differences and keep your budgeting rhythm intact.

What is Crew?

Crew is a modern, high-yield checking account that lets you create “pockets” for your money—just like digital cash envelopes. No monthly fees, no minimums, and your whole account earns competitive interest.

When you start, Crew will have already created a couple of pockets for you. One of which is called Crew Checking. This is the pocket that your money will land in when you make a deposit.

TIP for Qube Users:

Think of the default “Crew Checking” pocket as your old “Unallocated” fund in Qube. It’s where new deposits land before you move money to specific pockets.

(Ignore this if you haven’t used Qube!)

Getting Started with Crew: Step-by-Step

1. Sign Up and Fund Your Account

- Download the Crew app (available for Apple and Android).

- Complete the quick sign-up (takes about 2 minutes!).

- Link your bank and make an initial deposit or direct deposit. (Tap Menu > Linked bank accounts > “+ Add,” then search for your current bank and follow the prompts)

- Crew supports instant virtual cards so you can start spending right away.

2. Create Your First Pockets

- Tap the account tile on the main screen to see “Pockets.”

- Add as many pockets as you want: Groceries, Bills, Family Fun, Emergency, whatever fits your life.

- Start simple—3 to 5 pockets is perfect. You can add more later!

TIP for Qube Users:

Think of Crew’s Pockets the same way you thinkg of individual Qubes. “categories.” There’s no “Qubes Cloud”—everything lives as a pocket in one account.

3. Set Up Rules (Autopilot)

- Crew’s “Autopilot” lets you move money automatically when your paycheck lands.

- Tap “Smart Banking” or “Autopilot” to start.

- Choose triggers (like “Direct Deposit” or “Paycheck Arrived”).

- Decide if you want to split by dollar amounts or percentages (e.g., 10% to Savings, $100 to Groceries).

- You can schedule rules for payday, month start, or manually whenever you review your budget.

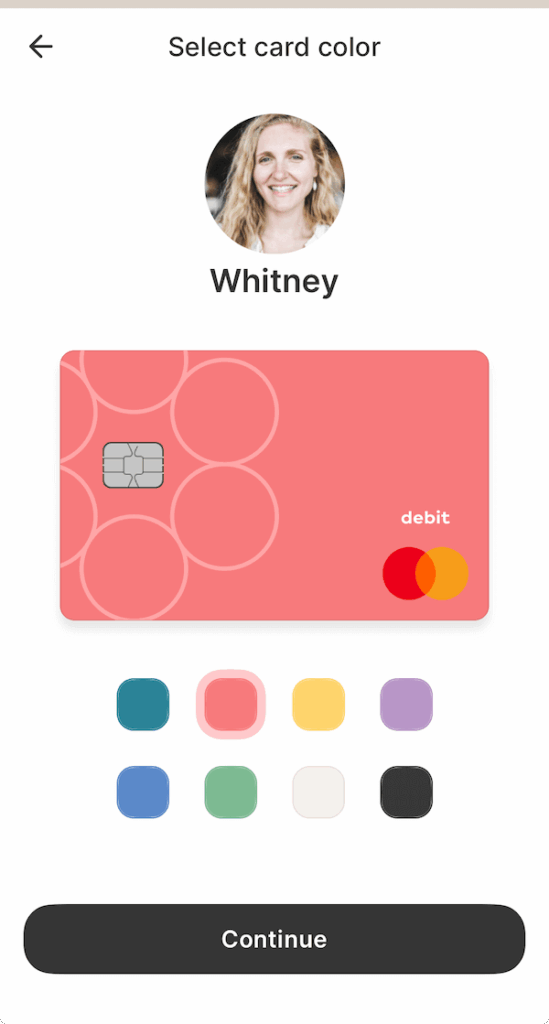

4. Order Your Physical Card

- You can order a physical Crew card by clicking tapping on going to the banking tab and scrolling down to a section where you can order a new debit card. NOTICE: Debit cards can’t be ordered until your account has been funded.

- While you wait for your card in the mail, you can instantly create virtual cards for online/subscription spending.

5. Spend Money

- Swipe to activate the pocket you want to spend from (“tap to pay” supported).

- Crew’s security: You control which pocket/card is active, and the card locks after use if you want strict control.

TIP for Qube Users:

In Qube, you “enabled” a Qube to spend. In Crew, you “activate” a pocket. You can also set the card to automatically lock (go to a $0 balance) after each use—just like Qube’s gated card.

6. Pay Bills and Use Autopilot

- Set up virtual cards for bills—one for each subscription or utility makes tracking easy.

- For bank drafts (ACH), Crew will pull from the pocket assigned, or from Crew Checking if not enough funds.

- Negative pockets are possible if a draft exceeds available balance; just move money to resolve this.

TIP for Qube Users:

Bills work similarly—assign a pocket! If a transaction lands in Crew Checking, just reassign it (like allocating from Unallocated).

7. Family Features and Allowances

- Add a partner for joint finances, or invite kids (no age limit!) so everyone gets their own pockets and cards.

- Designate allowances, split among spend/give/save like Qube’s kid-friendly features.

8. Monitor, Adjust, Enjoy Your Earnings

- View all pockets and balances instantly from the “Banking” screen.

- Interest (currently 3.45% APY + 0.5% bonus) is paid monthly and deposited to Crew Checking.

- No minimums, no fees. Move money anytime.

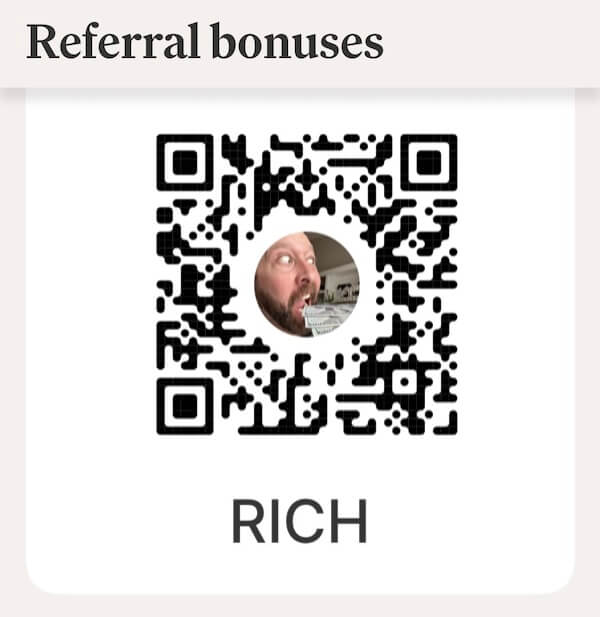

Affiliate Bonus:

Sign up with my Crew affiliate link for a .5% APY boost for three months—your entire family earns more on savings!

Qube to Crew: Key Similarities and Differences

| Feature | Qube | Crew | What to Expect |

|---|---|---|---|

| Unallocated Funds | Yes | Crew Checking | Where deposits land |

| Categories | Qubes as envelopes | Pockets as envelopes | Same core concept |

| Gated Card | Enable a Qube to spend | Activate a pocket to spend | Can auto-lock after purchase |

| Automation | Some (Auto-Allocation) | Strong (Autopilot/Rules) | More flexible in Crew |

| Joint/Family | Yes | Yes + Allowances features | Family is extra with Qube |

| Interest Rate | None | 3.45% + .5% bonus | Crew’s interest rate fluctuates based on the Fed Rate |

Crew Tips for All Users

- Start with simple pockets; review and optimize monthly.

- Use Autopilot to automate money movement (less manual work)!

- Take advantage of virtual cards for bills and subscriptions.

- Enjoy overdraft-free security; Crew won’t let you spend from empty pockets (unless you set it otherwise).

Final Thoughts & Support

Whether you’re new or switching over from another platform, you’ll enjoy powerful automation, instant access to pocketed funds, and great security. You can reach out for setup help. Don’t forget to use my affiliate code to boost your earnings.

Leave questions in the comments, or message me if you need step-by-step onboarding!

![Q&A Call [250x250]](https://www.richlivingcoaching.com/wp-content/uploads/2022/05/QA-Call-250x250-1.png)